⚠️ 4 EMI Warning Signs That Are Quietly Damaging Your Finances

Most people believe their loan is “manageable” simply because the EMI fits their monthly budget.

But the real danger of a loan doesn’t show up suddenly.It shows up slowly, quietly, and invisibly.

Month after month.Decision after decision.Percentage by percentage.

By the time most borrowers notice something is wrong, their savings are shrinking, stress is rising, and financial pressure is starting to feel normal.

This silent trap is what I call The EMI Danger Zone — and millions of people fall into it without realizing.

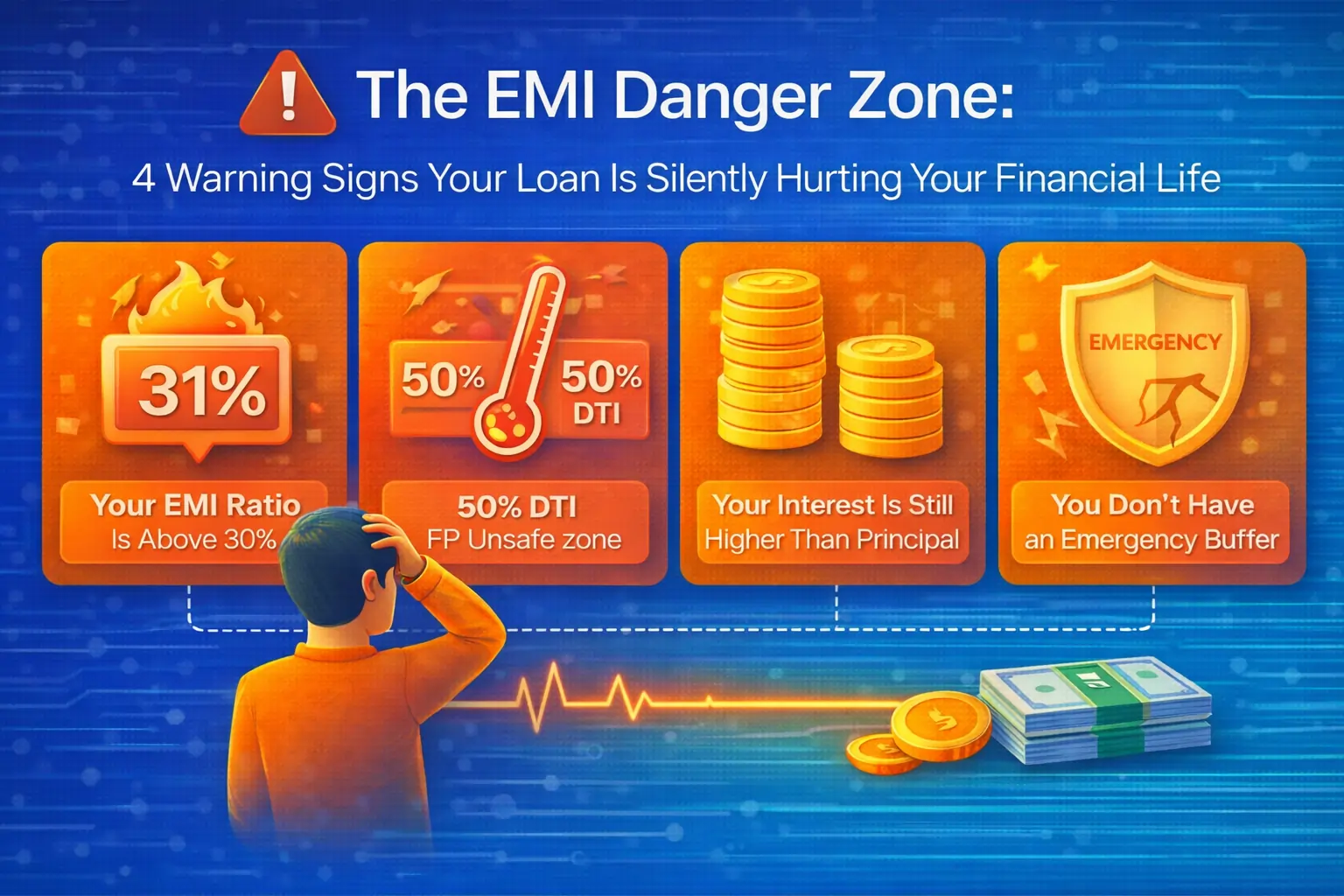

Here are the 4 warning signs that your loan is quietly damaging your financial health.🚩 1. Your EMI Ratio Is Above 30% — Your Lifestyle Starts Feeling Tight

Most people judge affordability with a single question:

“Does the EMI fit my salary?”

But affordability isn’t about how comfortable you feel today.It’s about how stable your finances remain tomorrow.

When your EMI goes above 30% of your income, your lifestyle begins to tighten. You slowly lose:

✔ Flexibility✔ Savings power✔ Freedom to spend or upgrade✔ Ability to manage unexpected costs

This is the first and most important red flag — yet it’s often ignored.🚩 2. Your DTI Crosses 50% — Your Financial Stability Is at Risk

Banks calculate your DTI (Debt-to-Income Ratio).Borrowers rarely do.

DTI = Total EMIs ÷ Income × 100

Once your DTI exceeds 50%, you quietly enter:

⚠ High-risk borrower zone⚠ Low-savings zone⚠ Chronic stress zone

Your income might be rising, but your financial freedom is shrinking.🚩 3. Your Interest Is Still Higher Than Principal — You’re Stuck in the Slow Lane

Here’s the truth banks don’t highlight:

During the early years of almost any loan:

➡ Most of your EMI pays interest➡ Only a small portion reduces principal

Many borrowers assume their loan is progressing…but if your EMI still has more interest than principal, you’re barely moving forward.

It’s like running on a treadmill — working hard, going nowhere.

This “interest trap” is one of the biggest silent signs your loan is hurting you.🚩 4. You Don’t Have an Emergency Buffer — One Shock Can Break Everything

Even a perfectly structured loan becomes risky without a safety cushion.

A financial buffer is not optional.It’s part of your loan protection system.

Without 3–6 months of expenses saved, a single unexpected event like:

⚠ Job loss⚠ Medical emergency⚠ Family crisis⚠ Business slowdown

can instantly push you into a debt spiral.

When there’s no backup,even a small EMI becomes dangerous.🔥 Why These Warning Signs Matter

Most people think loan danger looks like:

❌ Banks calling❌ EMI defaults❌ Loan rejection

But the real danger starts much earlier.

It shows up as:

✔ Slow or no savings✔ Feeling stressed every month✔ No emergency funds✔ Loan principal barely reducing✔ Feeling “stuck” despite salary hikes

These signs appear long before the actual financial breakdown.

And that’s exactly why the EMI Danger Zone is so dangerous.🤖 Gearskit Shows Your EMI Danger Level Instantly

You don’t need spreadsheets.You don’t need formulas.You don’t need to be a finance expert.

Gearskit gives you instant clarity through:

📊 EMI-to-Income Ratio📉 Debt-to-Income Ratio (DTI)💸 Interest vs Principal Split💙 Affordability Score⏳ Tenure Impact🛡 Emergency Buffer Strength🤖 AI-Powered Loan Fix Suggestions

In a few seconds, you’ll know exactly whether your loan is safe — or silently hurting you.

👉 Check your EMI Danger Level now: www.gearskit.com🧭 Final Thought

You don’t need to wait for a crisis to discover your loan is hurting your financial stability.

The warning signs are always there — you just need to know what to look for.

Financial health isn’t about paying EMI on time.It’s about ensuring your EMI isn’t quietly damaging your future.

Take control now — the sooner you act, the safer you’ll be.

Plan Smarter. Pay Less. Live Freely.

Topics Covered

Team GearsKit

Verified AuthorTeam GearsKit is a financial expert with years of experience in loan management and EMI calculations. Passionate about helping people make informed financial decisions.