More Salary, Same Stress: Why Your Money Never Feels Enough

You get a raise.You switch jobs.Your salary increases.

For a moment, life feels easier… lighter.But soon, the same feeling returns:

😞 Your salary still feels “not enough”😞 You still feel tight😞 You still struggle to save😞 You still feel financially behind

If this feels familiar, you’re not alone.

Millions of people experience this — at every income level.

And the shocking truth is:

👉 Your income is NOT the problem.Your EMI ratios are.

Let’s break down why even a high salary can feel small.

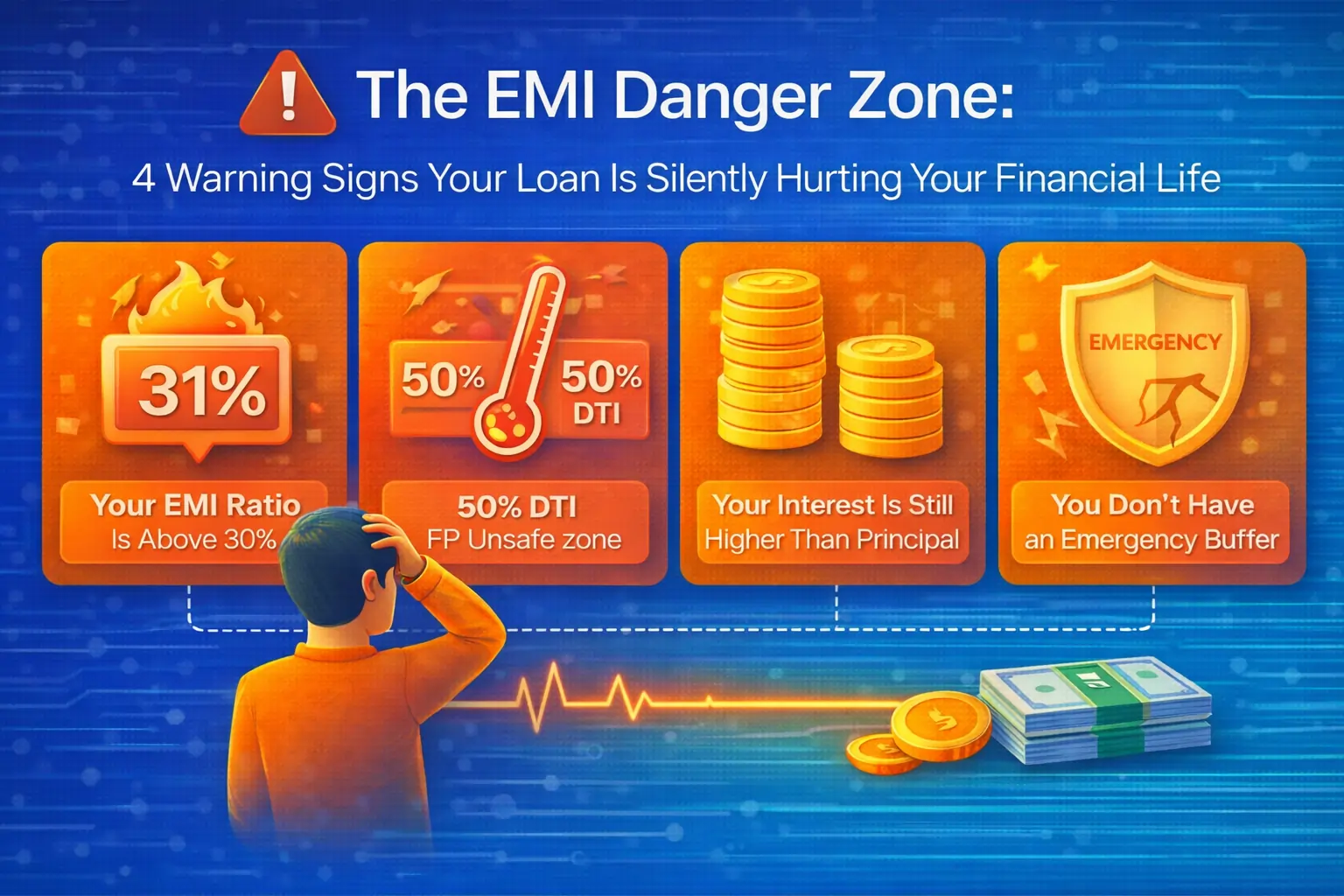

💡 Reason 1: Your EMI Exceeds 30% of Your Income

This is the biggest reason your salary never feels enough — even after a hike.

If your EMI is more than 30% of your monthly income, financial pressure becomes constant.

Why?

⚠ Less money left for lifestyle⚠ No room for emergencies⚠ Higher dependence on credit⚠ No flexibility⚠ Constant background stress

It doesn’t matter if you earn ₹30,000 or ₹3,00,000 —if EMI > 30%, your salary ALWAYS feels insufficient.💡 Reason 2: Total EMIs > 50% — The Silent Salary Killer

When more than half of your income goes toward EMIs, your financial life suffocates.

⚠ Savings disappear⚠ Investments stop⚠ Emergency funds shrink⚠ You feel stuck every month⚠ Stress becomes normal

This is how even high-income earners start feeling broke.

It’s NOT the income.It’s the Debt-to-Income Ratio (DTI).💡 Reason 3: Long Tenures Make Your Salary Feel Smaller

Banks promote long tenures as “easy and convenient.”

But in reality:

Long tenure = More years stuck paying EMIs = More interest paid

You stay committed for:

20 years…25 years…30 years…

Your salary increases…But your EMI remains — and so does the burden.

Your income grows.Your freedom doesn’t.💡 Reason 4: Missing Savings Buffer = Permanent Stress

If you don’t have at least 3–6 months of expenses saved, your salary always feels unstable.

Your mind stays in:

⚠ “What if something happens?”⚠ “What if the job changes?”⚠ “What if there’s an emergency?”

Without safety → income feels insufficient.💡 Reason 5: Lifestyle Cuts Don’t Fix Bad EMI Ratios

You may reduce expenses, cancel subscriptions, or cut luxuries…

But if your EMI ratios are unhealthy,nothing changes.

📌 Income increase ≠ Comfort increase📌 Only EMI correction = Stress reduction

A ₹1,00,000 salary can feel like ₹40,000if your EMI takes too much of it.

A ₹50,000 salary can feel comfortableif EMI ratios are healthy.

👉 Income is NOT the deciding factor — your EMI structure is.⭐ The Real Truth:

Your Salary Is Enough. Your EMI Structure Isn’t.

Financial peace isn’t about earning more —it’s about allocating better.

When your EMI is too big, even a big salary feels small.When your EMI is optimized, even a modest income feels manageable.

🚀 How to Fix the Problem: Start With Your EMI Ratios

Here’s the global rule for financial stability:

📌 EMI ≤ 30% of income📌 Total EMIs ≤ 50% of income📌 Emergency savings = 3–6 months of expenses📌 Avoid maxing out loan tenure📌 Use small prepayments to reduce interest

These five shifts change everything.⚙️ Gearskit Fixes This in Just 10 Seconds

Gearskit reveals what your bank never shows:

📊 EMI-to-income ratio📉 Debt-to-income ratio💙 Affordability score💸 Safe EMI limit⏳ Ideal loan tenure🧠 AI-powered loan insights🛡 Financial safety score⚡ Prepayment optimization

This is the difference between feeling “broke” and feeling in control.

Try it now → www.gearskit.com

🧭 Final Thought

Your salary isn’t the reason you feel financially stuck.Your EMI structure is.

Fix your EMI ratios →Your income starts feeling enough.Your savings grow.Your confidence returns.Your stress fades.

Start by checking your Financial Freedom Score:👉 www.gearskit.com

Plan Smarter. Pay Less. Live Freely.🌐 Explore More Free Financial Guides

We’ve also published a library of beginner-friendly guides to help anyone understand loans, EMIs, interest, budgeting, and more.

📘 Loan & Finance Basics

1. What Is EMI? https://gearskit.com/learn/what-is-emi

2. Personal Finance Basics https://gearskit.com/learn/personal-finance-basics

3. Bank Negotiation Strategies https://gearskit.com/learn/bank-negotiation-strategies

4. Financial Formulas (Explained Simply) https://gearskit.com/financial-formulas🏡 Detailed Loan Guides

1. Home Loan Guide https://gearskit.com/home-loan-guide

2. Car Loan Guide https://gearskit.com/car-loan-guide

3. Personal Loan Guide https://gearskit.com/personal-loan-guide

4. Education Loan Guide https://gearskit.com/education-loan-guide

5. Business Loan Guide https://gearskit.com/business-loan-guide

6. Custom Loan Guide https://gearskit.com/custom-loan-guide

These guides help users understand EMIs, compare loans, negotiate better rates, and make confident financial decisions — anywhere in the world.

Topics Covered

Team GearsKit

Verified AuthorTeam GearsKit is a financial expert with years of experience in loan management and EMI calculations. Passionate about helping people make informed financial decisions.